dhugfe

-

Content Count

25 -

Joined

-

Last visited

Posts posted by dhugfe

-

-

This place is getting dumber by the day. once upon a time, this was a forum. looks like a tabloid now.

-

dhugfe;990860 wrote: Bingo

Bingo

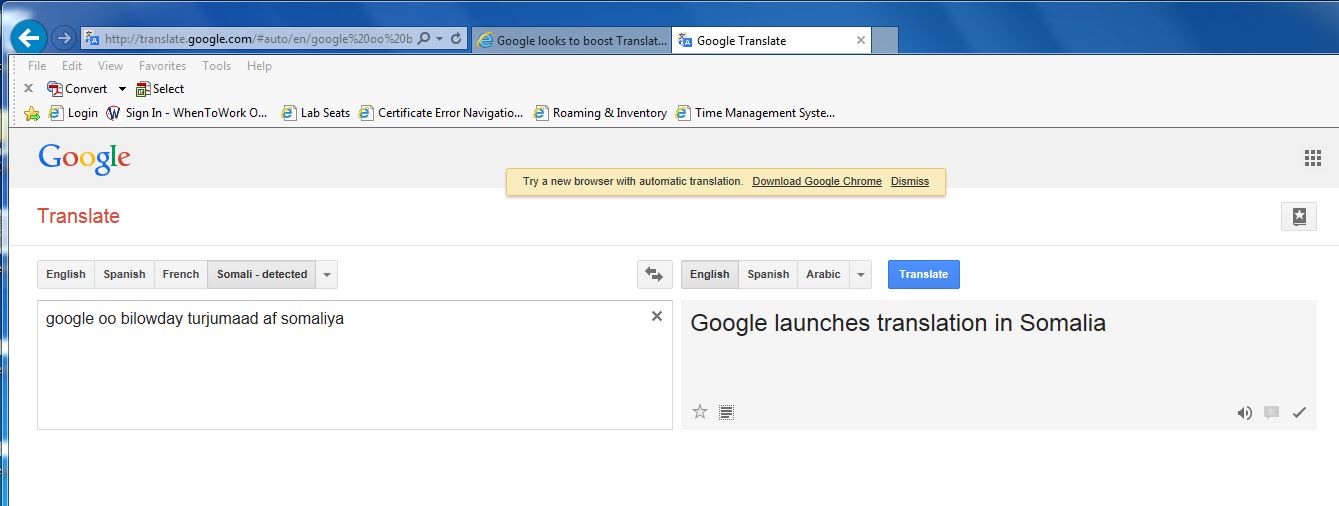

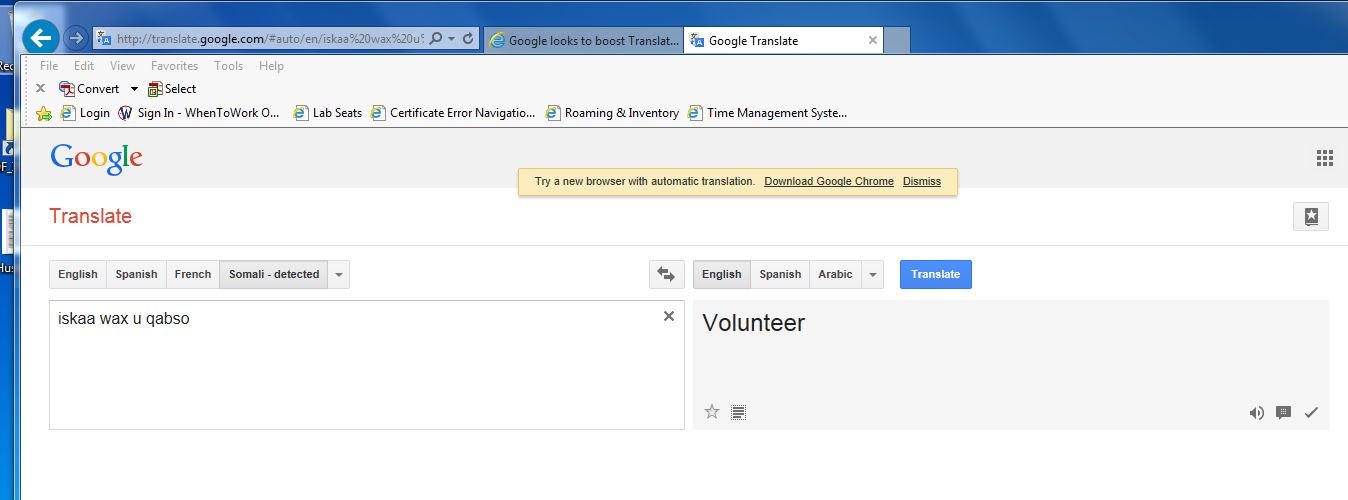

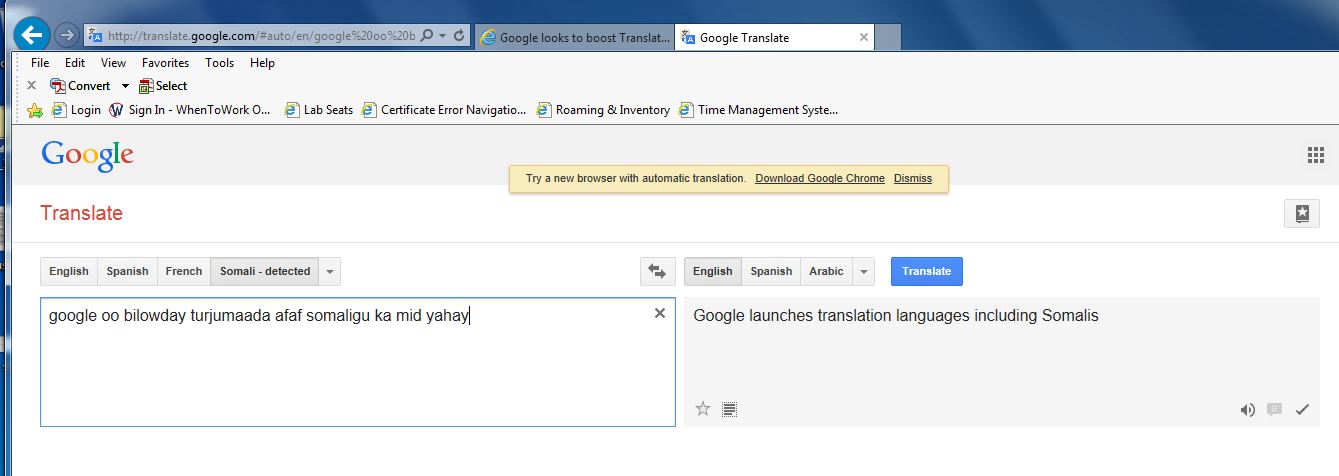

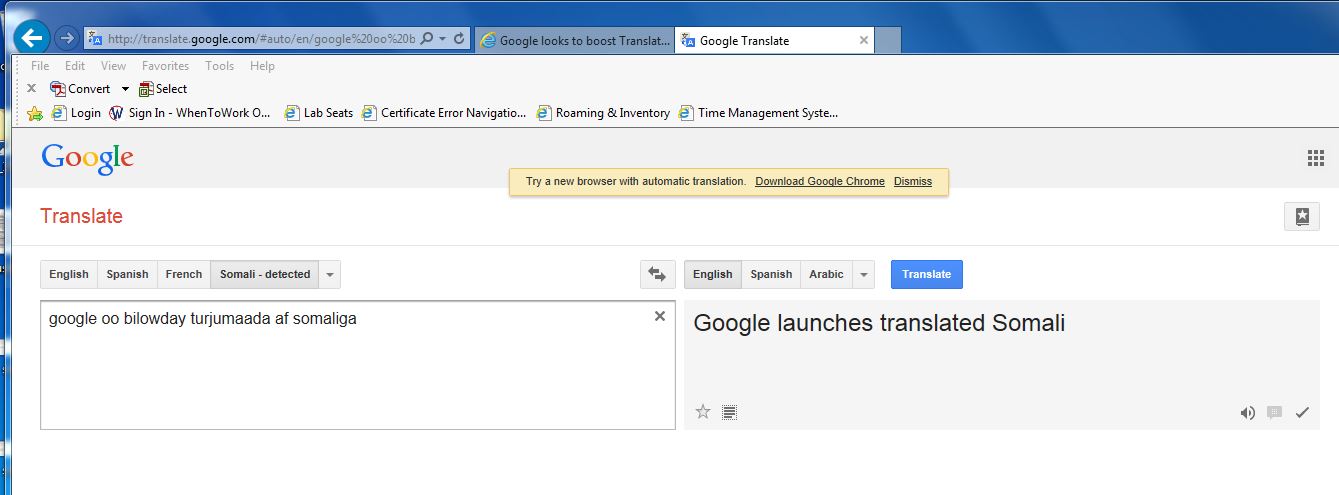

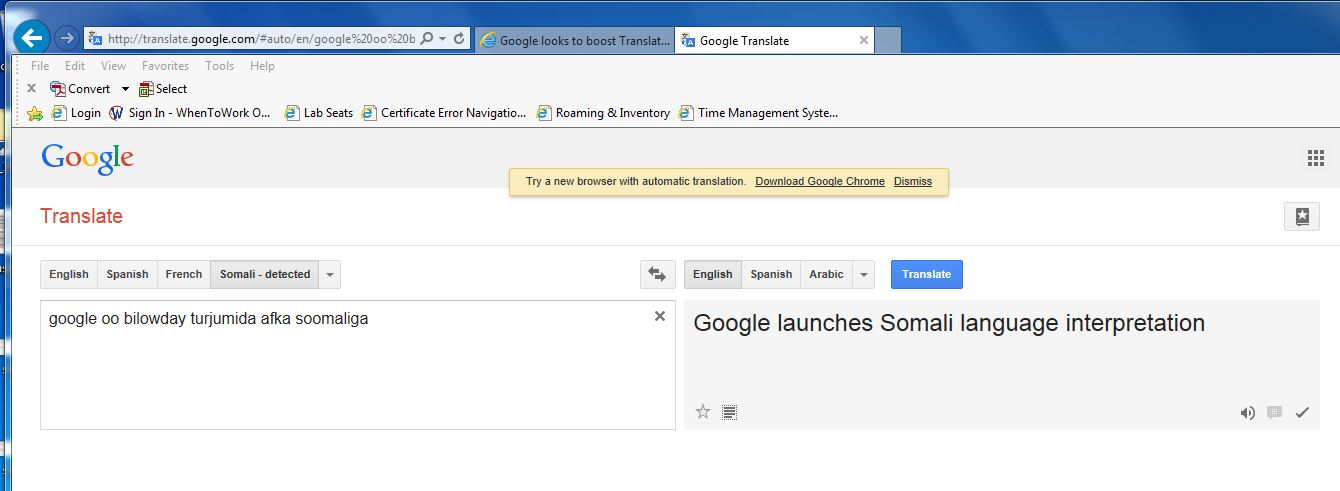

oh I read it as google launches translation in Somali, Bingo retracted

-

Ok

Awesome just a stray 's' right at the end

Not too bad

So close lol

Bingo

needs few extra tries to get what you need but kudos to every one that made this happen.

-

Tallaabo;986841 wrote:The Republic of Somaliland does not have any representatives in any other country's national parliament. It is up to the countries of the world to decide who sits in their respective parliaments but Somaliland has no influence in any other country's decision making. Of course Somaliland would not mind having its citizens in other countries' parliaments as that would give us diplomatic advantages. We hope more of our citizens join the national parliaments of Kenya, Ethiopia, Djibouti, the Sultanate of Ma...tania, Brazil, Saudi Arabia, USA, etc+1

-

Oodweyne;986864 wrote:^^^Mooge,If you are happy with name, we in turn are happy with the deeds. Furthermore, the Brits, who are after all the people given out these money knows perfectly well the "real name" of those recipient of their Counter-Terrorism( CT) effort. Hence, it's as if you are really reaching to make a point that is empty of meaning.In other words, the Brits (due to the sensibilities of the UN charter) may say we are given money to Northern Somalia, so that Hassan Sheikh and Co. will not start crying at the UN forum about the perfidious Brits "dividing-up" Somali republic, as their four-fathers have done.But, at the end of the day, everyone knows (most certainly the Brits knows) that this is a"semantics play"intended to cover (or insulate) the British against any accusation of encouraging internal division within the Somali Republic, by the ever enfeeble outfit that is based in Mogadishu, which, surprisingly passes itself off as a government of Somalia. All in all, see to it to learn the "double-language" of diplomacy and how it's especially useful in situation like this.

All in all, see to it to learn the "double-language" of diplomacy and how it's especially useful in situation like this.

+1

-

^ Cool thanks Safferz that explains why

-

Does every SOLer has the same picture size limit/quota? or is it a script thing?:confused:

The best I could do is 20 kb without losing quality. what am I missing here? lol :cool:

-

Xaaji Xunjuf;985452 wrote:Better than 20 years of homicide attacks warlordism/anarchism and piracy mass refugees Turks feeding the population and being under African union protection, now thats what i call sad.+1

-

-

guleed_ali;983237 wrote:The only thing they can't do is purchase the home and resell it to you. If I'm not mistaken banks cannot legally participate in the purchasing and selling of real estate. There in lies the problem! They can get as creative as they want but they still won't be able to satisfy the backbone of the agreement which is ownership and in turn shared risk.good point but I think they can if the home is foreclosed except they rather get rid of it fast than keeping it. why? I am not sure. Maybe there is a federal penalty if they keep the home for too long, that's why foreclosed homes are very cheap, the bank sells it on the cheap just to liquidate it, there are even reports that foreclosed homes can go for as low as $1000 in some locations :confused:

but you are right, that ownership of the home is one of the biggest obstacles faced by Islamic mortgage financing at least here in the states where banks cant really trade on property and if the bank cant co-own a property, there isn't much of a shared risk I guess.

guleed_ali;983237 wrote:I'm not sure how the bank's equity increases in my example it went down from 75% to 62.5%. Compare that to a conventional mortgage and you'll see a huge difference in principal between year 1 and year 5. Again I must remind everyone of the quranic verse:"That is because they say: Trade is just like usury; whereas Allah permitteth trading and forbiddeth usury" 2:275I didn't say it increased, I just took it as an example.

-

Don't know what happened there with the two posting. :confused:

I wish SOL had a post delete option lol

-

guleed_ali;983224 wrote:By that same logic when you rent an apartment your rent should never go up for the life of your tenancy. And please never use the word "loan" to describe and a sharia compliant partnership agreement. The only loan you can make in Islam is a Qard Hassan (قرض حسن) a loan that reaps no benefit. Because any loan that reaps a benefit is Riba (كل قرض جر نفعا فهو ربا)Thanks for the advice, I was just using that term for simplicity and relevancy to what khadafi mentioned only.

guleed_ali;983224 wrote:This is what bothesr dhugfe is thatthe rent amount changes. However for a true partnership you have to give your partner what the market rate is for the rent. So if the market rate falls (which hardly happens in this day in age) then your rent payment falls. I hope this explains it in a better way.I am not bothered by the fact that rent varies or changes, in fact, in my post, I specifically said it wasn’t a surprise that it does. Granted I did not show the calculus on how or why it increases like you did but only that it does and it isn’t a surprise.

We were just discussing a snapshot of the process and I was more or less concerned with the fact that anything that increases the bank’s equity in the home [62.5% in your example] is safe to say is Riba. Be it a fee or the likes, and trust me banks can get very creative when it comes to squeezing few more bucks out of you

-

guleed_ali;983224 wrote:By that same logic when you rent an apartment your rent should never go up for the life of your tenancy. And please never use the word "loan" to describe and a sharia compliant partnership agreement. The only loan you can make in Islam is a Qard Hassan (قرض حسن) a loan that reaps no benefit. Because any loan that reaps a benefit is Riba (كل قرض جر نفعا فهو ربا)Thanks for the advice, I was just using that term for simplicity and relevancy to what khadafi mentioned only.

guleed_ali;983224 wrote:This is what bothesr dhugfe is thatthe rent amount changes. However for a true partnership you have to give your partner what the market rate is for the rent. So if the market rate falls (which hardly happens in this day in age) then your rent payment falls. I hope this explains it in a better way.I am not bothered by the fact that rent varies or changes, in fact, in my post, I specifically said it wasn’t a surprise that it does. Granted I did not show the calculus on how or why it increases like you did but only that it does and it isn’t a surprise.

We were just discussing a snapshot of the process and I was more or less concerned with the fact that anything that increases the bank’s equity in the home [62.5% in your example] is safe to say is Riba. Be it a fee or the likes, and trust me banks can get very creative when it comes to squeezing few more bucks out of you

-

Khadafi;983217 wrote:That's what I thought dhigfe!. Why would a bank lend you money and on top of that make no profit on it?. Let's say that they did lend you the money but you were not able to pay the loan, who is going to pay them (or insurance them) for eventual losses when the house is sold byforce?.I am not so good on economics but thats my few coins on it.The bank co-owns the home. Think of it as if you and the bank went and bought the property, the bank puts most of the money and you put in some. The profit for the interest based bank is the interest, where for the Islamic bank is the rent. When the value of the home bought with an interest based mortgage falls, the bank wants 100% of its money in full with interest or it will foreclose on the house. The Islamic bank, however, shares the loss with you.

For example, suppose the value of the home was $250000 and the bank lent you 90% (225000) of it. If the value of the home falls to 200000 the next day, the Islamic bank still owns just 90% (180000) of the current value, that is a loss of (45000) for the bank and your loss is 10% (5000).

The interest-based bank would not have taken that lost, you would have still owned the bank the full (225000), and to make it worse, owe interest on that as well. Imaging owing 225000 on a home that is valued at 200000, you are underwater for 25000. This means that even if you sell the home for 200000, you’d still have to come up with extra 25000 plus interest for the bank or just pack and leave and let the bank have it.

-

Rahima;983019 wrote:Exactly, that is how it should be but as i asked above, do the "Islamic" banks work that way? I haven't seen any that do.I think the Islamic mortgage financing process is fixed and there is no two way about it. That process gets murky, however, when those “Islamic banks” try to alter that process to their advantage. For example, the monthly payment towards the principle (equity) should only cover the principle, remain fixed over the life of the loan and should be known in advance. Instead those banks try to make it variable to reflect the “market rate” which is nothing but interest and it increases the bank’s equity, which should never happen in this system. The only thing that is allowed to be variable, to reflect the “market rate”, is the rent portion which shouldn’t be a surprise because rent varies over the years.

There is a bank called lariba here in the states, and at first glance it looks legit, but further research might be needed. There is always something in the fine prints.

-

guleed_ali;982900 wrote:They didn't fear Allah when they committed this crime, what makes you think they'll fear SOL? La xawla wa la quwata ila billah!good point. but isn't that the sad world we live in these days, more and more people fearing what creatures would think/do instead of the creator? if for arguments sake it would indeed serve as a deterrent, isn't that a good thing?

-

Rahima;982837 wrote:^ The problem with Islamic banking these days is that whilst in principle they appear to be halal, when you get down to the nitty gritty detail you find that there really isn’t much difference between them and the interest based banks. With the two options you described, option 2 is only halal if the bank owned the property before you even approached them and option 1 is often fudged by these banks when it comes to the calculations where you realise that they just replace interest with rent.In saying that though- I too believe that wanting to move away does not mean that we shouldn’t invest in property if you can find a halal way. The way I see it is, even if I move (which I plan to inshallah), I can always rent out my house.the rent in option 1 is not interest, the thing is, both you and the bank own the equity to the house based on the proportion of your down payment. for example if you put 20% down, your equity is 20% and the bank's 80%. the payment you make are actually two payment. in the first one, you pay rent for living in the home the whole home freely without any interference from the bank (the co owner); an easement. on the second payment you buy the equity owned by the bank over time, increasing your equity and decreasing that of bank. the most critical moment here is, the fact that, unlike interest based mortgages, both you and the bank share what ever risk/profits that might come with the home. For instance if the home's value plummets, you only owe whatever your equity on the home was on that day and the bank shoulders the rest. That is huge, and if I am not mistaken, it is what makes it halal.

-

Riba ruins

-

I think this is an excellent thread; it serves as a deterrent for the morally weak who's still got the least bit of self-respect left. So to any Farah out there thinking of doing any of such heinous acts, smile you could be on SOL lol. I say, if anything, this thread needs more publicizing. If that is done; I bet those ever increasing Somali crime numbers in the west will take a nosedive.

p.s. NY’s mugshot, as stated by many nomads, should’ve been the first on the list.

-

aadmi la aragyaaba, dhib la arag: You see human, you see trouble

-

Coofle;975217 wrote:Siidh laga bixiyay lacag dhan 2 Million.....Rule number, Hadii la beero , Midhaha soo baxaa mar labaad lama sii beeri karo oo waxa lagu qasbanyahay in dib loo soo iibsado siidh cusub --rule number 1 , waana siyaasad ganacsi.Ta inoo taalaa waxa ay tahay in beeralayda la baro sidii ay uga faa'idaysan lahaayeen Siidhkan.This is like the first time your friend introduces you to weed/jaad/cigarette/balwad in general, they pay for the first few times and when you are hooked you start supplying the chain.....this means our agriculture after few years will be dependent on modified seeds, that we will join the global seed market.True there is a financial side to this, but also i would add that those GMOs litteraly changes the soil ecological balance making it harder to plant organic seeds again. it is a vicious cycle of both financial and biological dependency that is hard to break.

-

Carafaat;975152 wrote:Wiil Cusub,My biggest concern on GMO food is not related to the health concerns(risk on cancer). But on the prospect of the seeds being intellectual property and thus pattented by large multinationals. This could in turn make the food sector a monopoly of large firms, much like the pharmaceutical sector.To give you an example: Imagine I want to plant mais or tomatoes. You buy the seeds from a large corporation and then you harvest the mais or tomatoes. The problem starts when you want to use the seeds of the plants you harvest. These gmo plants have been geneticly modified and do not contain seeds you can use to plant again. This will force you to buy new seeds from the multinational. This will literly create a monopoly on the food chain.This isnt an issue for the rich countries but specially for countries in Africa. Just like the pattent on medicine is an issue for these countries and less for the west.1++++

-

-

A Collective Response to Dr. Markus Hoehne and the Somaliland Journal of African Studies

in General

Posted

Bravo